Usually when making the offer to purchase, the buyer has control on the subject removal date and the closing / possession date. Generally the closing dates tend to be on a Friday, around the 15th and 30th/31st of the month. Why? Because everyone picks those dates. But you don’t need to.

Why do strategic subject removal dates matter?

You are in the process of buying one of the most expensive items you will ever purchase. This is not the time to rush getting all of your ducks lined up. If you give yourself a short window of time for subject removal, say under10 days, by the time the contract is accepted by both buyer and seller that date has shrunk down to six or less days. Now you likely have to race to organize a building inspection, an appraisal and your financing documents. Bump the subject removal date out to a reasonable time frame like 12-14 days, starting after the deal is finally accepted and it will be easier on everyone.

Rushing can cost you more than you realize

Generally building inspectors will charge more for a rushed report, as will other professionals. Appraisers need enough time to access the property and write up the report properly. Then the lender needs time to review the report before signing off on it. Plus, if you are so pressed for time that you have to get the appraisal report done before the inspection report is completed, and you don’t end up purchasing, then those costs can be charged back to you. Rushing the process can really impact your ability to get the financing done on time, and even limit your financing options such that the best rates are no longer available.

Avoid Fridays and watch out for holidays

Choosing a Friday for a subject removal can also create added stress for everyone. For example, if the lender is backed up with files or located back East and leaves their office by 2 pm local time and you need an extension, you have to ask for a three-day extension to get you through the weekend. If your subject removal is earlier in the week, usually a 24 hour extension is sufficient. A request to have someone stay late to work on your file will go over far better on a Tuesday than a Friday when they are running out the door to enjoy their weekend plans.

Choosing a Friday for a subject removal can also create added stress for everyone. For example, if the lender is backed up with files or located back East and leaves their office by 2 pm local time and you need an extension, you have to ask for a three-day extension to get you through the weekend. If your subject removal is earlier in the week, usually a 24 hour extension is sufficient. A request to have someone stay late to work on your file will go over far better on a Tuesday than a Friday when they are running out the door to enjoy their weekend plans.

Another fatal mistake is choosing the Monday or the Friday of a long weekend to remove subjects – which are pretty much hopeless dates as we all know bankers do not work holidays (even if your fabulous mortgage broker does!) What this really means is that you’ve really just given your team three days less to clear subjects as it will need to be done at least one day before the long-weekend begins, to be safe.

Just say no to closing on the 15th or 30th

Closing / possession dates are just as important. Let’s say you’ve picked the 15th or the last day of the month for closing and now discover that all the moving companies either have their vans/ trucks already spoken for or they charge a premium for those dates. Cleaning companies are the same. Even many lawyers and notaries experience their heaviest volumes toward the end of the month. And they tend to charge more for a rushed deal, especially if they are already slammed.

Now imagine what could happen if you unknowingly choose the tri-fecta of horrible closing dates – Friday, long weekend and end of the month. Not only would you run into more expensive closing costs, but there is also a very good chance that the deal’s financing won’t come through in time which means the whole thing can go sideways!

So when you are ready to write an offer, grab a calendar and make sure that the dates you’ve chosen work well for your whole team of professionals and you’ll save yourself some money and plenty of grey hairs along the way.

Download Article Here.pdf

____________________________________________

About the Author:

Karen Garrett of DLC Sea to Sky Mortgages has over 25 years of financial service industry experience with 17 of those years as a professional mortgage broker. She has extensive industry knowledge and has been recognized among the top 2% of Canadian Mortgage Professionals in Canada for the past three years by the Canadian Mortgage Professionals Association.

www.karengarrett.ca/profile

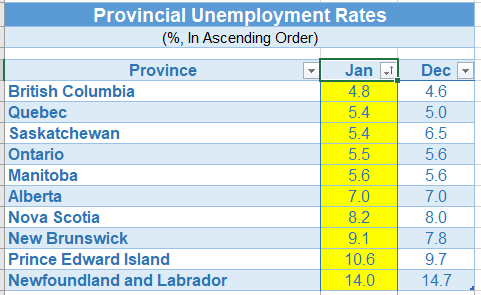

Canada shed 88,000 jobs in January, the most significant drop in nine years, driven by a record 137,000 plunge in part-time work. Full-time employment was up 49,000 while the unemployment rate increased a tick to 5.9%–only slightly above the lowest jobless rate since 1976. January’s sharp decline brings to an end a stunning 17-month streak of gains. While the top-line loss of 88,000 jobs is striking, it still only retraced about 60% of the 146,000 jump in the past two months.

Canada shed 88,000 jobs in January, the most significant drop in nine years, driven by a record 137,000 plunge in part-time work. Full-time employment was up 49,000 while the unemployment rate increased a tick to 5.9%–only slightly above the lowest jobless rate since 1976. January’s sharp decline brings to an end a stunning 17-month streak of gains. While the top-line loss of 88,000 jobs is striking, it still only retraced about 60% of the 146,000 jump in the past two months.

Choosing a Friday for a subject removal can also create added stress for everyone. For example, if the lender is backed up with files or located back East and leaves their office by 2 pm local time and you need an extension, you have to ask for a three-day extension to get you through the weekend. If your subject removal is earlier in the week, usually a 24 hour extension is sufficient. A request to have someone stay late to work on your file will go over far better on a Tuesday than a Friday when they are running out the door to enjoy their weekend plans.

Choosing a Friday for a subject removal can also create added stress for everyone. For example, if the lender is backed up with files or located back East and leaves their office by 2 pm local time and you need an extension, you have to ask for a three-day extension to get you through the weekend. If your subject removal is earlier in the week, usually a 24 hour extension is sufficient. A request to have someone stay late to work on your file will go over far better on a Tuesday than a Friday when they are running out the door to enjoy their weekend plans.